Own the instalment experience

Offer flexible instalments under your brand to boost sales & grow loyalty.

Grow sales through instalments

Save on merchant fees

Strengthen customer relationships

Create an instalment experience your customers will love

0% interest

Over 3 months

Longer instalments

Up to 36 months

Flexible plans

Change in the app

Bigger purchases

Up to £12k credit line for your customers

Instant access

Setup in minutes

Available anywhere

Instore and online

Trusted brand

You stay front & centre

FCA regulated

Peace of mind

Offer flexible payments wherever they shop

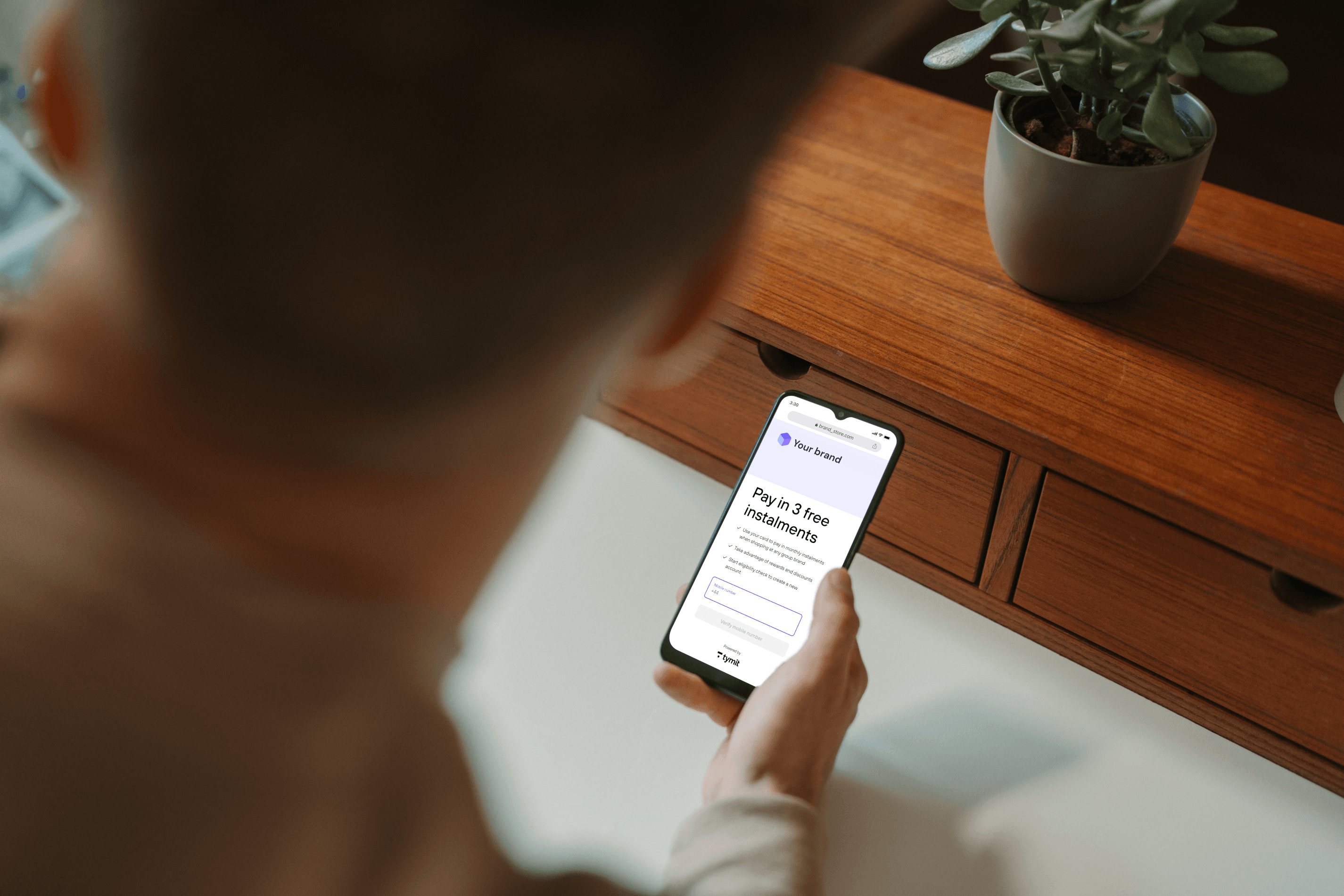

Card-linked instalments

An instantly issued virtual Visa card, offered under your brand and with no integration. After passing our eligibility checks, your customers get to pay in instalments - and you get to boost conversions with no merchant fees.

Embedded instalments

A seamless instalment experience embedded in your environment. Once they pass our eligibility checks, your customers can pay in instalments in just a few clicks, while you supercharge sales and save on charges.

Unlock benefits beyond the basket

FOR YOUR CUSTOMERS

Freedom to spend

In flexible instalments with a reusable credit line of their own

Peace of mind

Through transparency & control

FOR YOUR BUSINESS

Lower costs

With zero merchant fees

Loyal customers

Through data-driven engagement

Keep your brand centre stage

Capture more value than basic Buy Now, Pay Later

BNPL Instalments

Basic

More conversions

Bigger baskets

Card-linked Tymit Instalments

Bettered

More conversions

Bigger baskets

Cut merchant fees

Drive repeat spend

Own the experience

Embedded Tymit Instalments

Blown away

More conversions

Bigger baskets

Cut merchant fees

Drive repeat spend

Own the experience

No transaction fees

Optimised conversions

We’re more than a partner. We’re co-creators.

Together, we can create an instalment experience your customers will love.