Post-Covid Travel: How are Brits using credit?

With holidays abroad making a big comeback, we reveal how Brits are spending on credit.

Many Brits will be putting the last two years of lockdowns and travel restrictions behind them and heading abroad this year. In fact, holiday bookings are taking off this year, even with the cost of living crisis.

A report from EasyJet has revealed that UK holidaymakers are planning on spending more on holidays in 2022, with a third planning to spend £1,000+ more than usual on their next holiday. With this in mind, we surveyed 2,000 Brits to discover more about their spending habits abroad.

Who is using credit cards for holiday spending?

If you haven’t got all the money upfront for your holiday, using a credit card means you could still take advantage of cheap flights and deals by booking in advance.

However, our survey found that 18% of people are still paying off their holidays from last year. So, if you plan to spread the cost of your annual holiday, you should think carefully about the amount you want to spend and the timeframe it will take to pay it back, especially if using credit.

Buying your holiday using a credit card also often gives you the benefit of protection under section 75 of the Consumer Credit Act. So if anything goes wrong, for example, your tour operator goes bust, your credit card provider will be as liable as the retailer for refunding you.

This may explain why 3 in 10 (30%) people have previously used a credit card to finance their holiday abroad and a further 31% plan to use a credit card to finance their next holiday. But are there any generational differences when it comes to using credit cards for holiday spending?

Which cities are spending more on holidays?

The last few months have seen everything from fuel to food prices soar, with many being forced to tighten their day-to-day spending. But the same can’t be said about holiday spending, as nearly 3 in 10 (28%) still plan to spend more on holidays post-pandemic.

People from Sheffield are likely to splash the cash the most, with 33% planning to up their spending post-pandemic, followed closely by London, where 32% said they’re planning on spending more on holidays now travel restrictions have been lifted.

Our survey also found that more than 1 in 5 (21%) have used a credit card loan to upgrade their holiday, but which cities are most likely to make their holiday experience that little bit more special by paying for an upgrade?

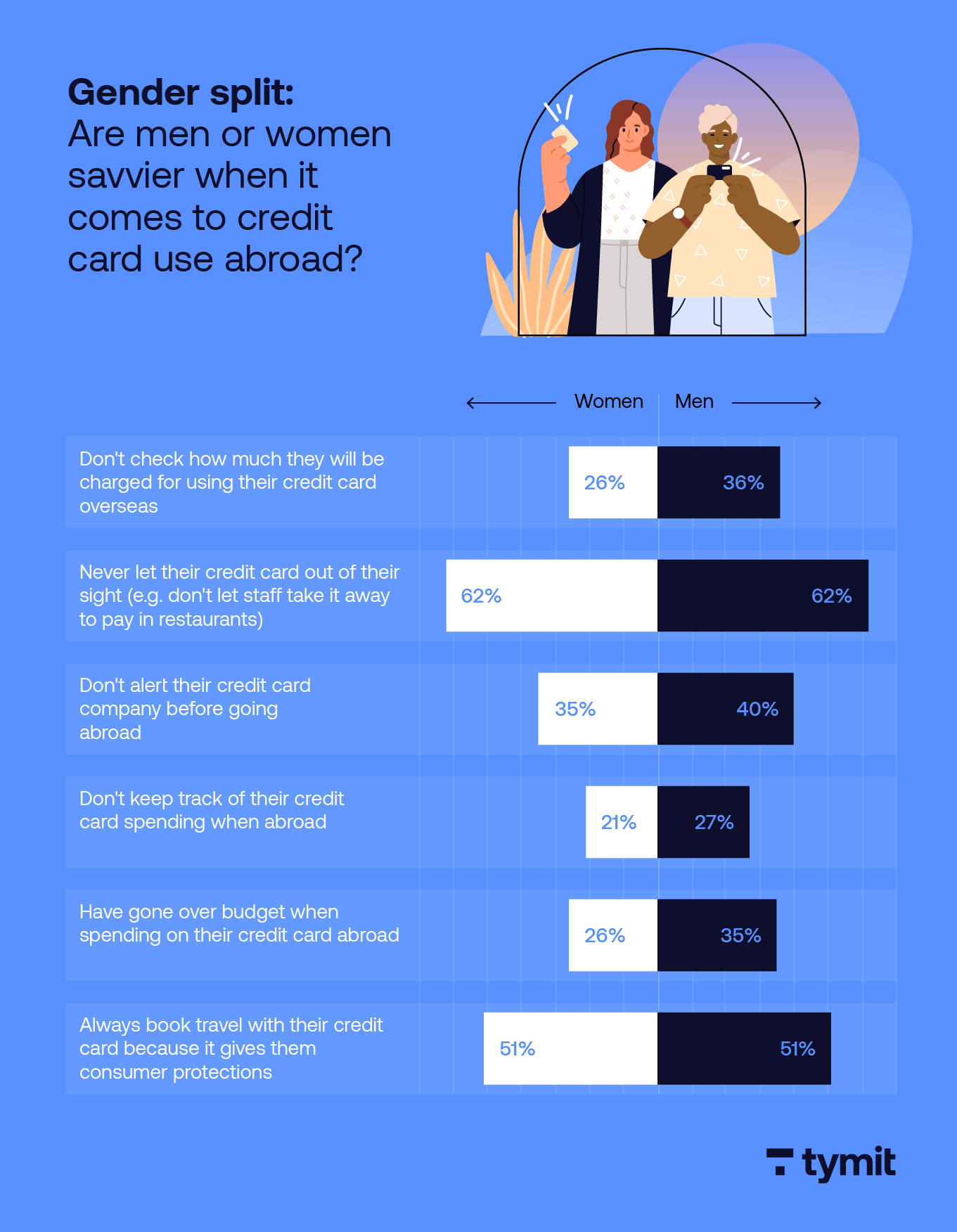

Are men or women savvier when it comes to credit card use abroad?

While you’ll always need some cash on a holiday, using a credit card for your spending needs can simplify overseas travel. That said, if you are planning a getaway, you should always check the cost of using your card abroad before you travel.

Provided with the right information, you can avoid hefty foreign transaction fees and charges on cash withdrawals. However, our survey found that 36% of men and more than 1 in 5 (26%) women said they don’t check how much they will be charged for using their credit card overseas. See how else men and women compare when it comes to using credit cards wisely.

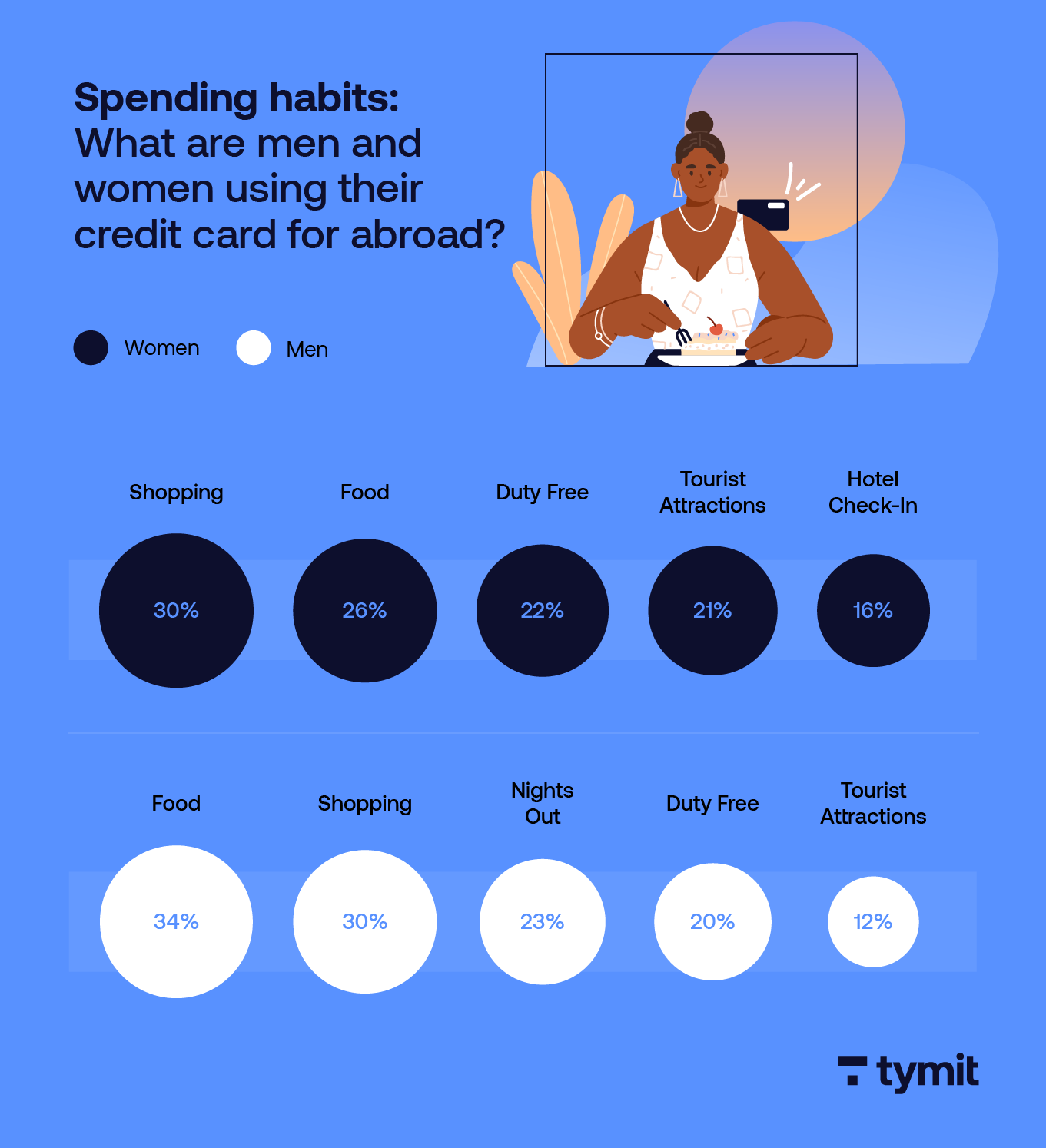

What are men and women using their credit cards for abroad?

When going abroad, cash may work for expenses such as tipping, but you may still want to use a credit card for accommodation, nights out, and other expenses.

You can use most credit cards overseas when shopping and dining out, assuming they accept your card. Whereas women are most likely to use their credit cards for shopping (30%), men prefer to use their credit cards for purchasing food (34%). See how else spending habits on holiday differ below.

How much is being spent on credit cards abroad?

Our survey found that 3 in 10 (30%) people have gone over budget when spending on their credit card abroad. This is higher in men, with 35% admitting to spending more than they budgeted for compared to just 26% of women. There are lots of ways in which you can plan your holiday spending so that you don’t go overboard. Planning in advance and keeping an eye on your budget while you’re away can help ensure that you don’t return home with hefty repayments.

On average, men like to spend more on holiday than women. Our survey found that men spend on average £192 on nights out and £204 on tourist attractions over the course of a holiday. Women, on the other hand, spend slightly less, with an average of £178 spent on nights out and £162 spent on tourist attractions.

There are many advantages to using a credit card when travelling. Not only are credit cards more convenient as they replace carrying large amounts of cash and remove the task of currency conversion, but they can also provide consumer protection if things go wrong. So, if you’re heading off on holiday overseas, here are some things to do before you get on the plane:

- Research where you’re going - Using your credit card is restricted in some countries so it’s best to check this before you go away.

- Let your card provider know - Before you go on holiday, it’s best to inform your credit card provider about your trip to avoid complications.

- Take a few payment options with you - You should always have some form of backup funds or alternatives to your credit card, just in case your card gets lost or stolen.

- Check your card expiry date - Your trip abroad might not go to plan if your credit card doesn't work, so make sure it’s not going to expire while you’re away.

- Check your contact details are correct - Make sure your contact details are up to date before you travel. This enables your credit card provider to get in touch with you if they need to.

Tymit gives you the financial freedom to live more and worry less. If you want to find out more about how you can gain control of your finances, find the best card for you here.